Advanced Accounting Hoyle 12th Edition Chapter 6 Solutions

solusi manual advanced acc zy Chap003

1

1

Like this document? Why not share!

- 15 Likes

- Statistics

- Notes

solusi manual advanced acc zy Chap003

- 1. Chapter 03 - The Reporting Entity and Consolidated Financial Statements CHAPTER 3 THE REPORTING ENTITY AND CONSOLIDATED FINANCIAL STATEMENTS ANSWERS TO QUESTIONS Q3-1 The basic idea underlying the preparation of consolidated financial statements is the notion that the consolidated financial statements present the financial position and the results of operations of a parent and its subsidiaries as if the related companies actually were a single company. Q3-2 Without consolidated statements it is often very difficult for an investor to gain an understanding of the total resources controlled by a company. A consolidated balance sheet provides a much better picture of both the total assets under the control of the parent company and the financing used in providing those resources. Similarly, the consolidated income statement provides a better picture of the total revenue generated and the costs incurred in generating the revenue. Estimates of future profit potential and the ability to meet anticipated funds flows often can be more easily assessed by analyzing the consolidated statements. Q3-3 Parent company shareholders are likely to find consolidated statements more useful. Noncontrolling shareholders may gain some understanding of the basic strength of the overall economic entity by examining the consolidated statements; however, they have no control over the parent company or other subsidiaries and therefore must rely on the assets and earning power of the subsidiary in which they hold ownership. The separate statements of the subsidiary are more likely to provide useful information to the noncontrolling shareholders. Q3-4 A parent company has the ability to exercise control over one or more other entities. Under existing standards, a company is considered to be a parent company when it has direct or indirect control over a majority of the common stock of another company. The FASB has proposed adoption of a broader definition of control that would not be based exclusively on stock ownership. Q3-5 Creditors of the parent company have primary claim to the assets held directly by the parent. Short-term creditors of the parent are likely to look only at those assets. Because the parent has control of the subsidiaries, the assets held by the subsidiaries are potentially available to satisfy parent company debts. Long-term creditors of the parent generally must rely on the soundness and operating efficiency of the overall entity, which normally is best seen by examining the consolidated statements. On the other hand, creditors of a subsidiary typically have a priority claim to the assets of that subsidiary and generally cannot lay claim to the assets of the other companies. Consolidated statements therefore are not particularly useful to them. 3-1

- 2. Chapter 03 - The Reporting Entity and Consolidated Financial Statements Q3-6 When one company holds a majority of the voting shares of another company, the investor should have the power to elect a majority of the board of directors of that company and control its actions. Unless the investor holds controlling interest, there is always a chance that another party may acquire a sufficient number of shares to gain control of the company, or that the other shareholders may join together to take control. Q3-7 The primary criterion for consolidation is the ability to directly or indirectly exercise control. Control normally has been based on ownership of a majority of the voting common stock of another company. The Financial Accounting Standards Board is currently working on a broader definition of control. At present, consolidation should occur whenever majority ownership is held unless other circumstances indicate that control is temporary or does not rest with the parent. Q3-8 Consolidation is not appropriate when control is temporary or when the parent cannot exercise control. For example, if the parent has agreed to sell a subsidiary or plans to reduce its ownership below 50 percent shortly after year-end, the subsidiary should not be consolidated. Control generally cannot be exercised when a subsidiary is under the control of the courts in bankruptcy or reorganization. While most foreign subsidiaries should be consolidated, subsidiaries in countries with unstable governments or those in which there are stringent barriers to funds transfers generally should not be consolidated. Q3-9 Strict adherence to consolidation standards based on majority ownership of voting common stock has made it possible for companies to use many different forms of control over other entities without being forced to include them in their consolidated financial statements. For example, contractual arrangements often have been used to provide control over variable interest entities even though another party may hold a majority (or all) of the equity ownership. Q3-10 Special purpose entities generally have been created by companies to acquire certain types of financial assets from the companies and hold them to maturity. The special purpose entity typically purchases the financial assets from the company with money received from issuing some form of collateralized obligation. If the company had borrowed the money directly, its debt ratio would be substantially increased. Q3-11 A variable purpose entity normally is not involved in general business activity such as producing products and selling them to customers. They often are used to acquire financial assets from other companies or to borrow money and channel it other companies. A very large portion of the assets held by variable purpose entities typically is financed by debt and a small portion financed by equity holders. Contractual agreements often give effective control of the activities of the special purpose entity to someone other than the equity holders. Q3-12 FIN 46R provides a number of guidelines to be used in determining when a company is a primary beneficiary of a variable interest entity. Generally, the primary beneficiary will absorb a majority of the entity's expected losses or receive a majority of the entity's expected residual returns. 3-2

- 3. Chapter 03 - The Reporting Entity and Consolidated Financial Statements Q3-13 Indirect control occurs when the parent controls one or more subsidiaries that, in turn, hold controlling interest in another company. Company A would indirectly control Company Z if Company A held 80 percent ownership of Company M and that company held 70 percent of the ownership of Company Z. Q3-14 It is possible for a company to exercise control over another company without holding a majority of the voting common stock. Contractual agreements, for example, may provide a company with complete control of both the operating and financing decisions of another company. In other cases, ownership of a substantial portion of a company's shares and a broad based ownership of the other shares may give effective control to a company even though it does not have majority ownership. There is no prohibition to consolidation with less than majority ownership; however, few companies have elected to consolidate with less than majority control. Q3-15 Unless intercorporate receivables and payables are eliminated, there is an overstatement of the true balances. The result is a distortion of the current asset ratio and other ratios such as those that relate current assets to noncurrent assets or current liabilities to noncurrent liabilities or to stockholders' equity balances. Q3-16 The consolidated statements are prepared from the viewpoint of the parent company shareholders and only the amounts assignable to parent company shareholders are included in the consolidated stockholders' equity balances. Subsidiary shares held by the parent are not owned by an outside party and therefore cannot be reported as shares outstanding. Those held by the noncontrolling shareholders are included in the balance assigned to noncontrolling shareholders in the consolidated balance sheet rather than being shown as stock outstanding. Q3-17 While it is not considered appropriate to consolidate if the fiscal periods of the parent and subsidiary differ by more than 3 months, a difference in time periods cannot be used as a means of avoiding consolidation. The fiscal period of one of the companies must be adjusted to fall within an acceptable time period and consolidated statement prepared. Q3-18 The noncontrolling interest, or minority interest, represents the claim on the net assets of the subsidiary assigned to the shares not controlled by the parent company. Q3-19 The procedures used in preparing consolidated and combined financial statements may be virtually identical. In general, consolidated statements are prepared when a parent company either directly or indirectly controls one or more subsidiaries. Combined financial statements are prepared for a group of companies or business entities when there is no parent-subsidiary relationship. For example, an individual who controls several companies may gain a clearer picture of the financial position and operating results of the overall operations under his or her control by preparing combined financial statements. 3-3

- 4. Chapter 03 - The Reporting Entity and Consolidated Financial Statements Q3-20* Under the proprietary theory the parent company includes only a proportionate share of the assets and liabilities and income statement items of a subsidiary in its financial statements. Thus, if a subsidiary is 60 percent owned, the parent will include only 60 percent of the cash and accounts receivable of the subsidiary in its consolidated balance sheet. Under current practice the full amount of the balance sheet and income statement items of the subsidiary are included in the consolidated statements. Q3-21* Under both current practice and the entity theory the consolidated statements are viewed as those of a single economic entity with a shareholder group that includes both controlling and noncontrolling shareholders, each with an equity interest in the consolidated entity. The assets and liabilities of the subsidiary are included in the consolidated statements at 100 percent of their fair value at the date of acquisition and consolidated net income includes the earnings to both controlling and noncontrolling shareholders. A major difference occurs in presenting retained earnings in the consolidated balance sheet. Only undistributed earnings related to the controlling interest are included in the retained earnings balance. Q3-22* The entity theory is closest to the newly adopted procedures used in current practice. 3-4

- 5. Chapter 03 - The Reporting Entity and Consolidated Financial Statements SOLUTIONS TO CASES C3-1 Computation of Total Asset Values The relationship observed should always be true. Assets reported by the parent company include its investment in the net assets of the subsidiaries. These totals must be eliminated in the consolidation process to avoid double counting. There also may be intercompany receivables and payables between the companies that must be eliminated when consolidated statements are prepared. In addition, inventory or other assets reported by the individual companies may be overstated as a result of unrealized profits on intercorporate purchases and sales. The amounts of the assets must be adjusted and the unrealized profits eliminated in the consolidation process. In addition, subsidiary assets and liabilities at the time the subsidiaries were acquired by the parent may have had fair values different from their book values, and the amounts reported in the consolidated financial statements would be based on those fair values. C3-2 Accounting Entity [AICPA Adapted] a. (1) The conventional or traditional approach has been used to define the accounting entity in terms of a specific firm, enterprise, or economic unit that is separate and apart from the owner or owners and from other enterprises. The accounting entity has not necessarily been defined in the same way as a legal entity. For example, partnerships and sole proprietorships are accounted for separately from the owners although such a distinction might not exist legally. Thus, it was recognized that the transactions of the enterprise should be accounted for and reported on separately from those of the owners. An extension of this approach is to define the accounting entity in terms of an economic unit that controls resources, makes and carries out commitments, and conducts economic activity. In the broadest sense an accounting entity could be established in any situation where there is an input-output relationship. Such an accounting entity may be an individual, a profit-seeking or not-for-profit enterprise, or a subdivision of a profit-seeking or not-for-profit enterprise for which a system of accounts is maintained. This approach is oriented toward providing information to the economic entity which it can use in evaluating its operating results and financial position. An alternative approach is to define the accounting entity in terms of an area of economic interest to a particular individual, group, or institution. The boundaries of such an economic entity would be identified by determining (a) the interested individual, group, or institution and (b) the nature of that individual's, group's, or institution's interest. In theory a number of separate legal entities or economic units could be included in a single accounting entity. Thus, this approach is oriented to the external users of financial reports. 3-5

- 6. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-2 (continued) (2) The way in which an accounting entity is defined establishes the boundaries of the possible objects, attributes, or activities that will be included in the accounting records and reports. Knowledge as to the nature of the entity may aid in determining (1) what information to include in reports of the entity and (2) how to best present information about the entity so that relevant features are disclosed and irrelevant features do not cloud the presentation. The applicability of all other generally accepted concepts (or principles or postulates) of accounting (for example, continuity, money measurement, and time periods) depends on the established boundaries and nature of the accounting entity. The other accounting concepts lack significance without reference to an entity. The entity must be defined before the balance of the accounting model can be applied and the accounting can begin. Thus, the accounting entity concept is so fundamental that it pervades all accounting. b. (1) Units created by or under law, such as corporations, partnerships, and, occasionally, sole proprietorships, probably are the most common types of accounting entities. (2) Product lines or other segments of an enterprise, such as a division, department, profit center, branch, or cost center, can be treated as accounting entities. For example, financial reporting by segment was supported by investors, the Securities and Exchange Commission, financial executives, and members of the accounting profession. (3) Most large corporations issue consolidated financial reports. These statements often include the financial statements of a number of separate legal entities that are considered to constitute a single economic entity for financial reporting purposes. (4) Although the accounting entity often is defined in terms of a business enterprise that is separate and distinct from other activities of the owner or owners, it also is possible for an accounting entity to embrace all the activities of an owner or a group of owners. Examples include financial statements for an individual (personal financial statements) and the financial report of a person's estate. (5) The entire economy of the United States also can be viewed as an accounting entity. Consistent with this view, national income accounts are compiled by the U. S. Department of Commerce and regularly reported. 3-6

- 7. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-3 Recognition of Fair Value and Goodwill MEMO TO: Mr. R. U. Cleer, Chief Financial Officer March Corporation From: Re: , CPA Analysis of changes resulting from FASB 141R March Corporation purchased 65 percent of the stock of Ember Corporation for $708,500 at a time when the book value of Ember's net assets was $810,000 and March's 65 percent share of that amount was $526,500. Management determined that the fair value of Ember's assets was $960,000, and March's 65 percent share of the difference between fair value and book value was $97,500. The remaining amount of the purchase price was allocated to goodwill, computed as follows: Purchase price Book value of 65 percent share of net assets Differential Fair value increment Goodwill $708,500 (526,500 ) $182,000 (97,500) $ 84,500 The reporting standards in effect at January 2, 2008, required March to include in its consolidated balance sheet 100 percent of the book value of Ember's net assets. The consolidated balance sheet also included the amount paid by March in excess of its share of book value, assigned to depreciable assets and goodwill. The noncontrolling interest was reported in the consolidated balance sheet at $283,500 ($810,000 x .35) and did not include any amounts related to the differential. Under FASB Statement No. 141R, the amounts included in the consolidated balance sheet are based on the $1,090,000 total fair value of Ember at the date of combination, as evidenced by the fair value of the consideration given in the exchange by March Corporation ($708,500) and the fair value of the noncontrolling interest ($381,500). The assets of Ember are valued at their $960,000 total fair value, resulting in a $150,000 increase over their book value. Goodwill is calculated as the difference between the $1,090,000 total fair value of Ember and the $960,000 fair value of its assets. The noncontrolling interest is valued initially at its fair value at the date of combination. The following comparison shows the amounts related to Ember that were reported in March's consolidated balance sheet prepared immediately after the acquisition of Ember and the amounts that would have been reported had FASB Statement No. 141R been in effect: Prior Standards $810,000 97,500 84,500 $992,000 Book value of Ember's net assets Fair value increment Goodwill Total Noncontrolling interest C3-3 (continued) $283,500 3-7 FASB 141R $ 810,000 150,000 130,000 $1,090,000 $381,500

- 8. Chapter 03 - The Reporting Entity and Consolidated Financial Statements Amortization of the fair value increment in March's 2008 consolidated income statement was $9,750 ($97,500/10). Under FASB Statement No. 141R, the annual write-off would have been $15,000 ($150,000/10). Primary citations: FASB 141 FASB 141R C3-4 Joint Venture Investment a. ARB No. 51 and FASB Interpretation No. 46R (FIN 46R) are the primary authoritative pronouncements dealing with the types of ownership issues arising in this situation. Under normal circumstances, the company holding majority ownership in another entity is expected to consolidate that entity in preparing its financial statements. Thus, unless other circumstances dictate, Dell should have planned to consolidate DFS as a result of its 70 percent equity ownership. While FIN 46R is a highly complex document and greater detail of the ownership agreement may be needed to decide this matter, the interpretation appears to permit equity holders to avoid consolidating an entity if the equity holders (1) do not have the ability to make decisions about the entity's activities, (2) are not obligated to absorb the expected losses of the entity if they occur, or (3) do not have the right to receive the expected residual returns of the entity if they occur [FIN 46R, Par. 5b]. It does appear that Dell and CIT Group do, in fact, have the ability to make operating and other decisions about DFS, they must absorb losses in the manner set forth in the agreement, and they must share residual returns in the manner set forth in the agreement. Control appears to reside with the equity holders and should not provide a barrier to consolidation. Dell might argue that it need not consolidate DFS because the joint venture agreement apparently did allocate losses initially to CIT. However, these losses were to be recovered from future income. Thus, both Dell and CIT were to be affected by the profits and losses of DFS. Given the importance of DFS to Dell and representation on the board of directors by CIT, DFS would not be expected to sustain continued losses. In light of the joint venture arrangement and Dell's ownership interest, consolidation by Dell seems appropriate and there seems to be little support for Dell not consolidating DFS. b. Dell fully consolidated DFS in its latest financial statements in which the joint venture is reported. Dell indicated that it is the primary beneficiary of DFS. Under the revised joint venture agreement, both profits and losses of DFS are shared 70 percent to Dell and 30 percent to CIT. Thus, with a 70 percent ownership interest and an allocation of losses in addition to profits, the requirement to consolidate DFS is quite clear. Note (from Dell's SEC Form 10-K) that Dell has an option to purchase CIT's interest in DFS. Thus, DFS may become wholly owned by Dell. c. Yes, Dell does employ off-balance sheet financing. It sells customer financing receivables to qualifying special purpose entities. In accordance with current standards, qualifying SPEs are not consolidated. 3-8

- 9. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-5 Need for Consolidation [AICPA Adapted] a. All identifiable assets acquired and liabilities assumed in a business combination, whether or not shown in the financial statements of Moore, should be valued at their fair values at the date of acquisition. Then, the excess of the fair value of the consideration given by Sharp to acquire its ownership interest in Moore, plus the fair value of the noncontrolling interest, over the sum of the amounts assigned to the identifiable assets acquired less liabilities assumed should be recognized as goodwill. b. Consolidated financial statements should be prepared in order to present the financial position and operating results for an economic entity in a manner more meaningful than if separate statements are prepared. c. The usual first necessary condition for consolidation is a controlling financial interest. Under current accounting standards, a controlling financial interest is assumed to exist when one company, directly or indirectly, owns over fifty percent of the outstanding voting shares of another company. C3-6 What Company is That? Information for answering this case can be obtained from the SEC's EDGAR database (www.sec.gov) and from the home pages for Viacom (www.viacom.com), ConAgra (www.conagra.com), and Yum! Brands (www.yum.com). a.. Viacom is well known for ownership of companies in the entertainment industry. On January 1, 2006, Viacom divided its operations by spinning off to Viacom shareholders ownership of CBS Corporation. Following the division Viacom continues to own MTV, Nickelodeon, Nick at Nite, Comedy Central, CMT, Country Music Television, Paramount Pictures, Paramount Home Entertainment, SKG, BET, Dreamworks, and other related companies. Summer Redstone holds controlling interest in both Viacom and CBS and serves as Executive Chairman of both companies. b. Some of the well-known product lines of ConAgra include Healthy Choice, Pam, Peter Pan, Slim Jim, Swill Miss, Orville Redenbacher's, Hunt's, Reddi-Wip, VanCamp, Libby's, LaChoy, Egg Beaters, Wesson, Banquet, Blue Bonnet, Chef Boyardee, Parkay, and Rosarita. c. Yum! Brands, Inc., is the world's largest quick service restaurant company. Well known brands include Taco Bell, A&W, KFC, and Pizza Hut. Yum was originally spun off from Pepsico in 1997. Prior to its current name, Yum's name was TRICON Global Restaurants, Inc. 3-9

- 10. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-7 Subsidiaries and Core Businesses Most of the information needed to answer this case can be obtained from articles available in libraries, on the Internet, or through various online databases. Some of the information is available in filings with the SEC (www.sec.gov). a. General Electric was never able to turn Kidder, Peabody into a profitable subsidiary. In fact, Kidder became such a drain on the resources of General Electric, that GE decided to get rid of Kidder. Unfortunately, GE was unable to sell the company as a whole and ultimately broke the company into pieces and sold the pieces that it could. GE suffered large losses from its venture into the brokerage business. b. Sears, Roebuck and Co. has been a major retailer for many decades. For a while, Sears attempted to provide virtually all consumer needs so that customers could purchase financial and related services at Sears in addition to goods. It owned more than 200 other companies. During that time, Sears sold insurance (Allstate Insurance Group, consisting of many subsidiaries), real estate (Coldwell Banker Real Estate Group, consisting of many subsidiaries), brokerage and investment advisor services (Dean Witter), credit cards (Sears and Discover Card), and various other related services through many different subsidiaries. During the mid-nineties, Sears sold or spun off most of its subsidiaries that were unrelated to its core business, including Allstate, Coldwell Banker, Dean Witter, and Discover. On March 24, 2005, Sears Holding Corporation was established and became the parent company for Sears, Roebuck and Co. and K Mart Holding Corporation. From an accounting perspective, Kmart acquired Sears, even though Kmart had just emerged from bankruptcy proceedings. Following the merger the company now has approximately 2,350 full-line and off-mall stores and 1,100 specialty retail stores in the United States, and approximately 370 full-line and specialty retail stores in Canada. c. PepsiCo entered the restaurant business in 1977 with the purchase of Pizza Hut. By 1986, PepsiCo also owned Taco Bell and KFC (Kentucky Fried Chicken). In 1997, these subsidiaries were spun off to a new company, TRICON Global Restaurants, with TRICON's stock distributed to PepsiCo's shareholders. TRICON Global Restaurants changed its name to YUM! Brands, Inc., in 2002. Although PepsiCo exited the restaurant business, it continued in the snack-food business with its Frito-Lay subsidiary, the world's largest maker of salty snacks. d. When consolidated financial statements are presented, financial statement users are provided with information about the company's overall operations. Assessments can be made about how the company as a whole has fared as a result of all its operations. However, comparisons with other companies may be difficult because the operations of other companies may not be similar. If a company operates in a number of different industries, consolidated financial statements may not permit detailed comparisons with other companies unless the other companies operate in all of the same industries, with about the same relative mix. Thus, standard measures used in manufacturing and merchandising, such as gross margin percentage, inventory and receivables turnover, and the debt-to-asset ratio, may be useless or even misleading when significant financialservices operations are included in the financial statements. Similarly, standard measures used in comparing financial institutions might be distorted when financial statement information includes data relating to manufacturing or merchandising operations. A partial solution to the problem results from providing disaggregated (segment or line-of-business) information along with the consolidated financial statements, as required by the FASB. 3-10

- 11. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-8 International Consolidation Issues The following answers are based on information from the Financial Accounting Standards Board website at www.fasb.org, the International Accounting Standards Board website at www.iasb.org, and from the PricewaterhouseCoopers publication entitled Similarities and Differences ─ A Comparison of IFRS and US GAAP, available at www.pwc.com/extweb/pwcpublications.nsf/docid/74d6c09e0a4ee610802569a1003354c8. PWC updates the site regularly, and more current information may be available. a. Parent companies must prepare consolidated financial statements that include all subsidiaries. However, if the parent itself is wholly owned by another entity, the company may be exempt from this requirement. For the company to be exempt, the owners of the minority interest must have been informed and they must indicate that they do not object to omitting the consolidated statements. Additionally, the parent's securities must not be publicly traded and the parent must not be in the process of issuing such securities. Further, the immediate or ultimate parent must still publish consolidated financial statements that comply with IFRS. b. According to IFRS, if any excess of fair value over the purchase price arises, the acquiring company must reassess the acquired identifiable assets, liabilities and contingent liabilities to determine that they have been properly identified and valued. The acquiring company must also reassess the cost of the combination. If there is still a differential after reassessment, this amount is recognized immediately in the income statement. This treatment is consistent with the FASB's current standard on business combinations (FASB Statement No. 141R). c. Under IFRS, Goodwill is reviewed annually (or more frequently) for impairment. Goodwill is initially allocated at the organizational level where cash flows can be clearly identified. These cash generating units (CGUs) may be combined for purposes of allocating goodwill and for the subsequent evaluation of goodwill for potential impairment. However, the aggregation of CGUs for goodwill allocation and evaluation must not be larger than a segment. Similar to U.S. GAAP, the impairment review must be done annually, but the evaluation date does not have to coincide with the end of the reporting year. However, if the annual impairment test has already been performed prior to the allocation of goodwill acquired during the fiscal year, a subsequent impairment test is required before the balance sheet date. While U.S. GAAP requires a two-step impairment test, IFRS requires a one-step test. The recoverable amount, which is the greater of the net fair market value of the CGU and the value of the unit in use, is compared to the book value of the CGU to determine if an impairment loss exists. A loss exists when the carrying value exceeds the recoverable amount. This loss is recognized in operating results. The impairment loss applies to all of the assets of the unit and must be allocated to assets in the unit. Impairment is allocated first to goodwill. If the impairment loss exceeds the book value of goodwill, then allocation is made on a pro rata basis to the other assets in the CGU. 3-11

- 12. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-9 Off-Balance Sheet Financing and VIEs a. Off-balance sheet financing refers to techniques that allow companies to borrow while keeping the debt, and related assets, from being reported in the company's balance sheet. b. (1) Funds to acquire new assets for a company may be borrowed by a third party such as a VIE, with the acquired assets then leased to the company. (2) A company may sell assets such as accounts receivable instead of using them as collateral. (3) A company may create a new VIE and transfer assets to the new entity in exchange for cash. c. VIEs may serve a genuine business purpose, such as risk sharing among investors and isolation of project risk from company risk. d. VIEs may be structured to avoid consolidation. To the extent that standards for consolidation are rule-based, it is possible to structure a VIE so that it is not consolidated even if the underlying economic substance of the entity would indicate that it should be consolidated. By artificially removing debt, assets, and expenses from the financial reports of the sponsoring company, the financial position of a company and the results of its operations can be distorted. The FASB has been working to ensure that rule-based consolidation standards result in financial statements that reflect the underlying economic substance. C3-10 Alternative Accounting Methods a. Amerada Hess's (www.hess.com) interests in oil and gas exploration and production ventures are proportionately consolidated (pro rata consolidation), a frequently found industry practice in oil and gas exploration and production. Investments in affiliated companies, 20 to 50 percent owned, are reported using the equity method. A 50 percent interest in a trading partnership over which the company exercises control is consolidated. b. Although EnCana Corporation (www.encana.com) reports investments in companies over which it has significant influence using the equity method. Investments in jointly controlled companies and ventures are accounted for using proportionate consolidation. EnCana is a Canadian company. Proportionate consolidation is found more frequently outside of the United States. Although not considered generally accepted in the United States, proportionate (pro rata) consolidation is nevertheless sometimes found in the oil and gas exploration and transmission industries. c. If a joint venture is not incorporated, its treatment is less clear than for corporations. Generally, the equity method should be used, but companies sometimes use proportionate consolidated citing joint control as the reason. 3-12

- 13. Chapter 03 - The Reporting Entity and Consolidated Financial Statements C3-11 Consolidation Differences among Major Corporations a. 1Union Pacific is rather unusual for a large company. It has only two subsidiaries: Union Pacific Railroad Company Southern Pacific Rail Corporation b.1 Exxon Mobil does not consolidate majority owned subsidiaries if the minority shareholders have the right to participate in significant management decisions. Exxon Mobil does 1consolidate some variable interest entities even though it has less than majority ownership according to its Form 10-K "because of guarantees or other arrangements that create majority economic interests in those affiliates that are greater than the Corporation's voting interests." The company uses 1the equity method, cost method, and fair value method to account for investments in the common stock of companies in which it holds less than majority ownership. 3-13

- 14. Chapter 03 - The Reporting Entity and Consolidated Financial Statements SOLUTIONS TO EXERCISES E3-1 Multiple-Choice Questions on Consolidation Overview [AICPA Adapted] 1. d 2. c 3. b 4. a 5. b E3-2 Multiple-Choice Questions on Variable Interest Entities 1. c 2. d 3. a 4. b 5. b E3-3 Multiple-Choice Questions on Consolidated Balances [AICPA Adapted] 1. a 2. b 3. b 4. c 5. a 3-14

- 15. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-4 Multiple-Choice Questions on Consolidation Overview [AICPA Adapted] 1. d 2. a 3. b 4. d E3-5 Balance Sheet Consolidation a. $470,000 = $470,000 - $55,000 + $55,000 b. $605,000 = ($470,000 - $55,000) + $190,000 c. $405,000 = $270,000 + $135,000 d. $200,000 (as reported by Guild Corporation) E3-6 Balance Sheet Consolidation with Intercompany Transfer a. $645,000 = $510,000 + $135,000 b. $845,000 = $510,000 + $350,000 - $15,000 c. $655,000 = ($320,000 + $135,000) + $215,000 - $15,000 d. $190,000 (as reported by Potter Company) E3-7 Intercompany Transfers a. Consolidated current assets will be overstated by $37,000 if no eliminations are made. Inventory will be overstated by $25,000 and accounts receivable will be overstated by $12,000. b. Net working capital will be overstated by $25,000 due to unrealized intercompany inventory profits. The overstatement of accounts payable and accounts receivable will offset. c. Net income of the period following will be understated by $25,000 as a result of overstating cost of goods sold by that amount. 3-15

- 16. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-8 Subsidiary Acquired for Cash Fineline Pencil Company and Subsidiary Consolidated Balance Sheet January 2, 20X3 Cash ($200,000 - $150,000 + $50,000) Other Assets ($400,000 + $180,000) Total Assets $100,000 580,000 $680,000 Current Liabilities ($100,000 + $80,000) Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $180,000 300,000 200,000 $680,000 E3-9 Subsidiary Acquired with Bonds Byte Computer Corporation and Subsidiary Consolidated Balance Sheet January 2, 20X3 Cash ($200,000 + $50,000) Other Assets ($400,000 + $180,000) Total Assets $250,000 580,000 $830,000 Current Liabilities Bonds Payable Bond Premium Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $140,000 10,000 $180,000 150,000 300,000 200,000 $830,000 E3-10 Subsidiary Acquired by Issuing Preferred Stock Byte Computer Corporation and Subsidiary Consolidated Balance Sheet January 2, 20X3 Cash ($200,000 + $50,000) Other Assets ($400,000 + $180,000) Total Assets $250,000 580,000 $830,000 Current Liabilities ($100,000 + $80,000) Preferred Stock ($6 x 15,000) Additional Paid-In Capital ($4 x 15,000) Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $180,000 90,000 60,000 300,000 200,000 $830,000 3-16

- 17. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-11 Reporting for a Variable Interest Entity Gamble Company Consolidated Balance Sheet Cash Buildings and Equipment Less: Accumulated Depreciation Total Assets $370,600,000(b) (10,100,000 ) Accounts Payable Bonds Payable Bank Notes Payable Noncontrolling Interest Common Stock Retained Earnings Total Liabilities and Equities (a) $18,600,000 (b) $370,600,000 $ 18,600,000(a) 360,500,000 $379,100,000 $ $103,000,000 105,200,000 5,000,000 20,300,000 140,000,000 5,600,000 208,200,000 $379,100,000 = $3,000,000 + $5,600,000 + ($140,000,000 – $130,000,000) = $240,600,000 + $130,000,000 E3-12 Consolidation of a Variable Interest Entity Teal Corporation Consolidated Balance Sheet Total Assets $682,500(a) Total Liabilities Noncontrolling Interest Common Stock Retained Earnings Total Liabilities and Equities $550,000(b) 22,500(c) (a) $682,500 (b) $550,000 (c) $22,500 = = = $15,000 95,000 $500,000 + $190,000 - $7,500 $470,000 + $80,000 ($500,000 - $470,000) x .75 3-17 110,000 $682,500

- 18. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-13 Computation of Subsidiary Net Income Messer Company reported net income of $60,000 ($18,000 / .30) for 20X9. E3-14 Incomplete Consolidation a. Belchfire apparently owns 100 percent of the stock of Premium Body Shop since the balance in the investment account reported by Belchfire is equal to the net book value of Premium Body Shop. b. Accounts Payable $ 60,000 Accounts receivable were reduced by $10,000, presumably as a reduction of receivables and payables. Bonds Payable 600,000 There is no indication of intercorporate ownership. Common Stock 200,000 Common stock of Premium must be eliminated. Retained Earnings 260,000 Retained earnings of Premium also must be eliminated in preparing consolidated statements. $1,120,000 E3-15 Noncontrolling Interest a. The total noncontrolling interest reported in the consolidated balance sheet at January 1, 20X7, is $126,000 ($420,000 x .30). b. The stockholders' equity section of the consolidated balance sheet includes the claim of the noncontrolling interest and the stockholders' equity section of the subsidiary is eliminated when the consolidated balance sheet is prepared: Controlling Interest: Common Stock Additional Paid-In Capital Retained Earnings Total Controlling Interest Noncontrolling Interest Total Stockholders' Equity $ 400,000 222,000 358,000 $ 980,000 126,000 $1,106,000 c. Sanderson is mainly interested in assuring a steady supply of electronic switches. It can control the operations of Kline with 70 percent ownership and can use the money that would be needed to purchase the remaining shares of Kline to finance additional operations or purchase other investments. 3-18

- 19. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-16 Computation of Consolidated Net Income a. Ambrose should report income from its subsidiary of $15,000 ($20,000 x .75) rather than dividend income of $9,000. b. A total of $5,000 ($20,000 x .25) should be assigned to the noncontrolling interest in the 20X4 consolidated income statement. c. Consolidated net income of $70,0000 should be reported for 20X4, computed as follows: Reported net income of Ambrose Less: Dividend income from Kroop Operating income of Ambrose Net income of Kroop Consolidated net income $59,000 (9,000) $50,000 20,000 $70,000 d. Income of $79,000 would be attained by adding the income reported by Ambrose ($59,000) to the income reported by Kroop ($20,000). However, the dividend income from Kroop recorded by Ambrose must be excluded from consolidated net income. E3-17 Computation of Subsidiary Balances a. Light's net income for 20X2 was $32,000 ($8,000 / .25). b . Common Stock Outstanding (1) $120,000 Additional Paid-In Capital (given) Retained Earnings ($70,000 + $32,000) Total Stockholders' Equity 40,000 102,000 $262,000 (1) Computation of common stock outstanding: Total stockholders' equity ($65,500 / .25) Additional paid-in capital Retained earnings Common stock outstanding 3-19 $262,000 (40,000) (102,000 ) $120,000

- 20. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-18 Subsidiary Acquired at Net Book Value Banner Corporation and Subsidiary Consolidated Balance Sheet December 31, 20X8 Cash ($40,000 + $20,000) Accounts Receivable ($120,000 + $70,000) Inventory ($180,000 + $90,000) Fixed Assets (net) ($350,000 + $240,000) Total Assets $ 60,000 190,000 270,000 590,000 $1,110,000 Accounts Payable ($65,000 + $30,000) Notes Payable ($350,000 + $220,000) Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $ 95,000 570,000 150,000 295,000 $1,110,000 E3-19* Applying Alternative Accounting Theories a. Proprietary theory: Total revenue [$400,000 + ($200,000 x .75)] Total expenses [$280,000 + ($160,000 x .75)] Consolidated net income [$120,000 + ($40,000 x .75)] b. Parent company theory: Total revenue ($400,000 + $200,000) Total expenses ($280,000 + $160,000) Consolidated net income [$120,000 + ($40,000 x .75)] c. $600,000 440,000 150,000 Entity theory: Total revenue ($400,000 + $200,000) Total expenses ($280,000 + $160,000) Consolidated net income ($120,000 + $40,000) d. $550,000 400,000 150,000 $600,000 440,000 160,000 Current accounting practice: Total revenue ($400,000 + $200,000) Total expenses ($280,000 + $160,000) Consolidated net income ($120,000 + $40,000) 3-20 $600,000 440,000 160,000

- 21. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-20* Measurement of Goodwill a. $240,000 = computed in the same manner as under the parent company approach. b. $400,000 = $240,000 / .60 c. $400,000 = computed in the same manner as under the entity theory. E3-21* Valuation of Assets under Alternative Accounting Theories a. Entity theory: Book Value Fair Value Increase ($240,000 x 1.00) ($50,000 x 1.00) $240,000 50,000 $290,000 b. Parent company theory: Book Value Fair Value Increase ($240,000 x 1.00) ($50,000 x .75) $240,000 37,500 $277,500 c. Proprietary theory: Book Value Fair Value Increase ($240,000 x .75) ($50,000 x .75) $180,000 37,500 $217,500 d. Current accounting practice: Book Value Fair Value Increase ($240,000 x 1.00) ($50,000 x 1.00) $240,000 50,000 $290,000 3-21

- 22. Chapter 03 - The Reporting Entity and Consolidated Financial Statements E3-22* Reported Income under Alternative Accounting Theories a. Entity theory: Total revenue ($410,000 + $200,000) Total expenses ($320,000 + $150,000) Consolidated net income [$90,000 + ($50,000 x 1.00)] $610,000 470,000 140,000 b. Parent company theory: Total revenue ($410,000 + $200,000) Total expenses ($320,000 + $150,000) Consolidated net income [$90,000 + ($50,000 x .80)] $610,000 470,000 130,000 c. Proprietary theory: Total revenue [$410,000 + ($200,000 x .80)] Total expenses [$320,000 + ($150,000 x .80)] Consolidated net income [$90,000 + ($50,000 x .80)] $570,000 440,000 130,000 d. Current accounting practice: Total revenue ($410,000 + $200,000) Total expenses ($320,000 + $150,000) Consolidated net income [$90,000 + (50,000 x 1.00)] E3-23* Acquisition of Majority Ownership a. Net identifiable assets: $690,000 = $520,000 + $170,000 b. Goodwill: $30,000 = $200,000 - $170,000 c. Noncontrolling interest: $50,000 = $200,000 x .25 3-22 $610,000 470,000 140,000

- 23. Chapter 03 - The Reporting Entity and Consolidated Financial Statements SOLUTIONS TO PROBLEMS P3-24 Multiple-Choice Questions on Consolidated and Combined Financial Statements [AICPA Adapted] 1. d 2. c 3. b 4. c P3-25 Intercompany Sales a. Net income will be overstated by $30,000 ($50,000 - $20,000) if no adjustment is made to eliminate the effects of the intercompany transfer. b. Knight Corporation and Subsidiary Consolidated Income Statement Year Ended December 31, 20X6 Sales Cost of goods sold Consolidated net income c. $300,000 (200,000 ) $100,000 Knight Corporation and Subsidiary Consolidated Income Statement Year Ended December 31, 20X6 Sales Cost of goods sold Consolidated net income $250,000 (180,000 ) $ 70,000 d. Each of the three income statement items is changed when the effects of the intercompany sale are eliminated. 3-23

- 24. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-26 Intercompany Inventory Transfer a. Inventory on January 1, 20X3: Balance reported by River Products Unrealized profits recognized by Clayborn Consolidated inventory $25,000 (15,000) $10,000 b. Cost of Goods Sold for 20X2: Cost of goods sold recorded by Clayborn Cost of goods sold recorded on intercompany sale Cost of goods sold recorded on sales to outsiders $10,000 (10,000) $ -0- c. Cost of Goods Sold for 20X3: Cost of goods sold recorded by River Products Profit recorded on intercompany sale by Clayborn Consolidated cost of goods sold $25,000 (15,000) $10,000 d. Sales for 20X2: Sales recognized by Clayborn Intercompany sale recorded by Clayborn Consolidated sales $25,000 (25,000) $ -0- e. Sales for 20X3: Sales recognized by River Products Intercompany sales during 20X3 Consolidated sales $55,000 (-0-) $55,000 3-24

- 25. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-27 Determining Net Income of Parent Company Consolidated net income Income of subsidiary ($15,200 / .40) Income from Tally's operations $164,300 (38,000) $126,300 P3-28 Reported Balances a. The investment balance reported by Roof will be $192,000. b. Total assets will increase by $310,000. c. Total liabilities will increase by $95,000. d. The amount of goodwill for the entity as a whole will be $25,000 [($192,000 + $48,000) - ($310,000 - $95,000)]. e. Noncontrolling interest will be reported at $48,000 ($240,000 x .20). P3-29 Acquisition Price a. $57,000 = ($120,000 - $25,000) x .60 b. $81,000 = ($120,000 - $25,000) + $40,000 - $54,000 c. $48,800 = ($120,000 - $25,000) + $27,000 - $73,200 3-25

- 26. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-30 Consolidation of a Variable Interest Entity Stern Corporation Consolidated Balance Sheet January 1, 20X4 Cash Accounts Receivable Less: Allowance for Uncollectibles Other Assets Total Assets $12,200,000 (610,000) Accounts Payable Notes Payable Bonds Payable Stockholders' Equity: Controlling Interest: Common Stock Retained Earnings Total Controlling Interest Noncontrolling Interest Total Stockholders' Equity Total Liabilities and Stockholders' Equity (a) $ 8,150,000 (b) $12,200,000 (c) $ 610,000 = = = (b) (c) $ 8,150,000 (a) 11,590,000 5,400,000 $25,140,000 $ 700,000 6,150,000 $ 6,850,000 40,000 950,000 7,500,000 9,800,000 $ $7,960,000 + $190,000 $4,200,000 + $8,000,000 $210,000 + $400,000 3-26 6,890,000 $25,140,000

- 27. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-31 Reporting for Variable Interest Entities Purified Oil Company Consolidated Balance Sheet Cash Drilling Supplies Accounts Receivable Equipment (net) Land Total Assets $ 640,000 420,000 640,000 8,500,000 5,100,000 $15,300,000 Accounts Payable Bank Loans Payable Stockholders' Equity: Controlling Interest: Common Stock Retained Earnings Total Controlling Interest Noncontrolling Interest Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ 590,000 11,800,000 $ 560,000 2,150,000 $2,710,000 200,000 2,910,000 $15,300,000 P3-32 Consolidated Income Statement Data a. Sales: ($300,000 + $200,000 - $50,000) $450,000 b. Investment income from LoCal Bakeries: $ c. Cost of goods sold: ($200,000 + $130,000 - $35,000) $295,000 d. Depreciation expense: ($40,000 + $30,000 + $6,250) $ 76,250 3-27 -0-

- 28. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-33 Incomplete Company and Consolidated Data a. A total of $210,000 ($120,000 + $90,000) should be reported. b. As shown in the investment account balance, Beryl paid $110,000 for the ownership of Stargel. The amount paid was $30,000 greater than the book value of the net assets of Stargel and is reported as goodwill in the consolidated balance sheet at January 1, 20X5. c. In determining the amount to be reported for land in the consolidated balance sheet, $15,000 ($70,000 + $50,000 - $105,000) was eliminated. Beryl apparently sold the land to Stargel for $25,000 ($10,000 + $15,000). d. Accounts payable of $120,000 ($75,000 + $55,000 - $10,000) will be reported in the consolidated balance sheet. A total of $10,000 was deducted in determining the balance reported for accounts receivable ($90,000 + $50,000 - $130,000). The elimination of an intercompany receivable must be offset by the elimination of an intercompany payable. e. The par value of Beryl's stock outstanding is $100,000. 3-28

- 29. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-34 Consolidation Following Intercompany Sale of Equipment Potash Company and Subsidiary Consolidated Balance Sheet January 1, 20X7 Cash ($50,000 + $35,000) Accounts Receivable ($110,000 + $60,000 - $17,000) Merchandise Inventory ($95,000 + $75,000) Equipment (net) ($230,000 + $105,000 - $25,000) Total Assets $ 85,000 153,000 170,000 310,000 $718,000 Accounts Payable ($82,000 + $28,000 - $17,000) Notes Payable ($200,000 + $107,000) Common Stock Retained Earnings ($163,000 - $25,000) Total Liabilities and Stockholders' Equity $ 93,000 307,000 180,000 138,000 $718,000 Note: The $25,000 ($110,000 - $85,000) profit recorded by Potash on the sale of equipment to Bortz must be eliminated by reducing the amount reported as equipment and the retained earnings balance reported by Potash. A total of $17,000 ($110,000 - $93,000) remains as an account receivable on the books of Potash and a payable on the books of Bortz at January 1, 20X7. These amounts must be eliminated in preparing the consolidated balance sheet. 3-29

- 30. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-35 Parent Company and Consolidated Amounts a. b. Common stock of Tempro Company on December 31, 20X5 Retained earnings of Tempro Company January 1, 20X5 Sales for 20X5 Less: Expenses Dividends paid Retained earnings of Tempro Company on December 31, 20X5 Net book value on December 31, 20X5 Proportion of stock acquired by Quoton Purchase price Net book value on December 31, 20X5 Proportion of stock held by noncontrolling interest Balance assigned to noncontrolling interest $ 90,000 $130,000 195,000 (160,000) (15,000) 150,000 $240,000 x .80 $192,000 $240,000 x .20 $ 48,000 c. Consolidated net income is $143,000. None of the 20X5 net income of Tempro Company was earned after the date of purchase and, therefore, none can be included in consolidated net income. d. Consolidate net income would be $178,000 [$143,000 + ($195,000 - $160,000)]. 3-30

- 31. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-36 Parent Company and Consolidated Balances a. b. Balance in investment account, December 31, 20X7 Exacto net assets on date of acquisition Cumulative earnings since acquisition Cumulative dividends since acquisition Net assets on December 31, 20X7 Proportion of stock held by True Corporation Book value of claim by True Corporation Unamortized differential December 31, 20X7 Number of years remaining for amortization Annual amortization Total years of amortization Amount paid in excess of book value $260,000 110,000 (46,000) $324,000 x .75 $259,800 (243,000) $ 16,800 ÷ 7 $ 2,400 x 10 $ 24,000 $32,000 ($24,000 / .75) will be added to buildings and equipment each year. c. $9,600 ($3,200 x 3 years) will be added to accumulated depreciation at December 31, 20X7. d. $86,600 = [($324,000 + $32,000 - $9,600) x .25] will be assigned to noncontrolling interest in the consolidated balance sheet prepared at December 31, 20X7. 3-31

- 32. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-37 Indirect Ownership The following ownership chain exists: Purple The earnings of Blue Company and Orange Corporation are included under cost method reporting due to the 10 percent ownership level of Orange Corporation. Net income of Green Company: . 70 Reported operating income Green Dividend income from Orange ($30,000 x .10) Equity-method income from Yellow ($60,000 x .40) .40 . 10 Green Company net income Yellow Consolidated net income: $ 20,000 3,000 24,000 $ 47,000 Orang e . 60 Operating income of Purple Net income of Green Consolidated net income Blue $ 90,000 47,000 $137,000 Purple company net income (Not Required): Operating income of Purple Purple's share of Green's net income ($47,000 x .70) Purple's net income 3-32 $ 90,000 32,900 $122,900

- 33. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-38 Comprehensive Problem: Consolidated Financial Statements a. Cash: $71,000 + $33,000 = $104,000 b. Receivables (net): $431,000 + $122,000 - $45,000 = $508,000 c. Inventory: $909,000 + $370,000 - ($45,000 - $34,000) = $1,268,000 d. Investment in Mangle Stock: Not reported in consolidated statements e. Equipment (net): $1,528,000 + $475,000 + $25,000(1) - $5,000(2) = $2,023,000 (1) $25,000 = [$55,000 – ($1,250,000 - $1,220,000)] (2) $5,000 = $25,000 / 5 years f. Goodwill: ($1,250,000 - $1,220,000) = $30,000 g. Current Payables: $227,000 + $95,000 - $45,000 = $277,000 h. Common Stock (par): $1,000,000 i. Sales Revenue: $8,325,000 + $2,980,000 - $45,000 = $11,260,000 j. Cost of Goods Sold: $5,150,000 + $2,010,000 - $34,000 = $7,126,000 k. Depreciation Expense: $302,000 + $85,000 + $5,000 = $392,000 3-33

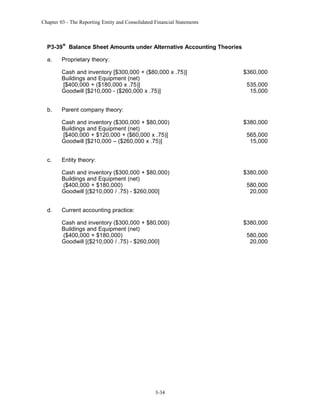

- 34. Chapter 03 - The Reporting Entity and Consolidated Financial Statements P3-39* Balance Sheet Amounts under Alternative Accounting Theories a. Proprietary theory: Cash and inventory [$300,000 + ($80,000 x .75)] Buildings and Equipment (net) [$400,000 + ($180,000 x .75)] Goodwill [$210,000 - ($260,000 x .75)] b. $380,000 565,000 15,000 Entity theory: Cash and inventory ($300,000 + $80,000) Buildings and Equipment (net) ($400,000 + $180,000) Goodwill [($210,000 / .75) - $260,000] d. 535,000 15,000 Parent company theory: Cash and inventory ($300,000 + $80,000) Buildings and Equipment (net) [$400,000 + $120,000 + ($60,000 x .75)] Goodwill [$210,000 – ($260,000 x .75)] c. $360,000 $380,000 580,000 20,000 Current accounting practice: Cash and inventory ($300,000 + $80,000) Buildings and Equipment (net) ($400,000 + $180,000) Goodwill [($210,000 / .75) - $260,000] 3-34 $380,000 580,000 20,000

Advanced Accounting Hoyle 12th Edition Chapter 6 Solutions

Source: https://www.slideshare.net/suzielestari/chap003-29583170